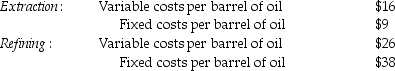

Axelia Corporation has two divisions,Refining and Extraction.The company's primary product is Luboil Oil.Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,900 barrels a day and usually purchases 25,600 barrels of oil from the Extraction Division and 15,400 barrels from other suppliers at $64 per barrel.

Assume 260 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $26 per barrel.The Refining Division sells the 260 barrels at a price of $220 each to customers.What is the operating income of both divisions together?

Definitions:

Franchise Fee Accounting

The process of recognizing and managing the fees paid and received for the right to use a franchisor’s trademark and operational model in accounting books.

Initial Franchise Fee

The fee paid by a franchisee to the franchisor at the beginning of the franchise agreement for the right to use the franchisor's brand, system, and support.

Revenue

The cumulative revenue obtained from selling goods or services integral to a business's core functions.

Cost Recovery Method

A revenue recognition approach where no profit is recognized until all the costs of the goods sold have been recovered from revenues.

Q44: Super Shoes Company manufactures sneakers.The Athletic Division

Q55: Plish Company manufactures only one type of

Q56: It is appropriate for service organizations such

Q86: What targets should companies use,and when should

Q88: The Allianz Company produces a specialty wood

Q107: The Comil Corporation recently purchased a new

Q118: In the service sector,to achieve timely reporting

Q146: Which of the following is a limitation

Q176: The classification of costs as variable and

Q206: Tally Corp.sells software during the recruiting seasons.During