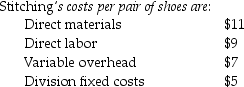

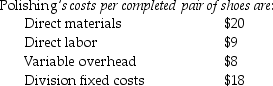

Branded Shoe Company manufactures only one type of shoe and has two divisions,the Stitching Division and the Polishing Division.The Stitching Division manufactures shoes for the Polishing Division,which completes the shoes and sells them to retailers.The Stitching Division "sells" shoes to the Polishing Division.The market price for the Polishing Division to purchase a pair of shoes is $48.(Ignore changes in inventory. ) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units.The fixed costs for the Polishing Division are assumed to be $17 per pair at 101,000 units.

What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

Definitions:

Tenancy in Common

A form of co-ownership where each party owns a separate fraction of the property and can transfer their interest independently.

Joint Tenancy

Joint ownership of property by two or more co-owners in which each co-owner owns an undivided portion of the property. On the death of one of the joint tenants, his or her interest automatically passes to the surviving joint tenant(s).

Ownership Interests

The rights and stake a person or entity has in property, including the rights to use, sell, or lease it.

Real Property

Land and anything permanently attached to it, such as buildings, in contrast to personal property, which is movable.

Q19: In situations where the required rate of

Q51: Soda Manufacturing Company provides vending machines for

Q63: Average number of repeat visits in a

Q70: A positive aspect of backflush costing is

Q82: Axelia Corporation has two divisions,Refining and Extraction.The

Q85: Ventaz Corp.purchased assets for its overseas branch

Q109: Historical-cost-based accounting measures are usually inadequate for

Q124: Accrual accounting rate of return is calculated

Q131: Measures which monitor critical performance variables that

Q207: For a manufacturing-sector company,the cost of factory