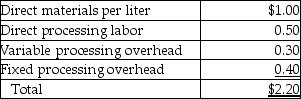

Olive Branch Company recently acquired an olive oil processing company that has an annual capacity of 2,000,000 liters and that processed and sold 1,400,000 liters last year at a market price of $4 per liter.The purpose of the acquisition was to furnish oil for the Cooking Division.The Cooking Division needs 800,000 liters of oil per year.It has been purchasing oil from suppliers at the market price.Production costs at capacity of the olive oil company,now a division,are as follows:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division.The manager of the Olive Oil Division argues that $4,the market price,is appropriate.The manager of the Cooking Division argues that the cost of $2.14 should be used,or perhaps a lower price,since fixed overhead cost should be recomputed with the larger volume.Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Required:

a.Compute the operating income for the Olive Oil Division using a transfer price of $4.

b.Compute the operating income for the Olive Oil Division using a transfer price of $2.20.

c.What transfer price(s)do you recommend? Compute the operating income for the Olive Oil Division using your recommendation.

Definitions:

Advertising Law

Regulations and legal standards that govern the ways in which products and services can be promoted to the public.

Deceptive Practices

Activities by individuals or businesses that mislead or lie to consumers, often regarding the nature or quality of a product or service.

Unfair Practices

Activities considered unethical or illegal, often related to business dealings, that can lead to consumer harm or market manipulation.

Discharged

Relieved from a legal duty, obligation, or liability, often in the context of debts or contractual obligations.

Q6: Globe Inc.is a distributor of DVDs.DVD Mart

Q22: Using net book value as an investment

Q33: The balanced scorecard in most organizations is

Q57: The following information is for Alex Corp:<br><img

Q83: Assigning indirect costs is easier than assigning

Q84: Sensitivity analysis is a simple approach to

Q87: In the "make decisions by choosing among

Q97: The annual relevant carrying costs of inventory

Q119: The following information is for the Jeffries

Q180: The following information pertains to Alleigh's Mannequins:<br><img