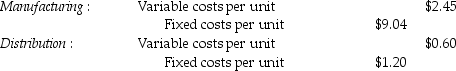

Timekeeper Corporation has two divisions,Distribution and Manufacturing.The company's primary product is high-end watches.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,010,000 units a week and usually purchases 2,005,000 units from the Manufacturing Division and 2,005,000 units from other suppliers at $15.00 per unit.

What is the transfer price per watch from the Manufacturing Division to the Distribution Division,assuming the method used to place a value on each transfer is 125% of full costs?

Definitions:

Recoverable Amount

The higher of an asset's fair value less costs to sell and its value in use, reflecting the maximum amount that can be recovered through its use or sale.

Expected Benefit Approaches

A method used in actuarial analysis or in benefits planning, projecting the future benefits to be received, often for purposes of pension plan funding or insurance.

Unverifiable

Pertaining to information or data that cannot be confirmed or corroborated through evidence or additional sources.

Unreliable

Lacking consistency, dependability, or accuracy in information, data, or result.

Q10: All other things held constant,increase in assets

Q28: Cost-based transfer prices are helpful when markets

Q41: Which of the following is a fixed

Q46: Aaron Corp's net income is $25,000.What is

Q56: Soft Cushion Company is highly decentralized.Each division

Q78: Globus Autos sells a single product.8,000 units

Q115: Tax deductions for depreciation result in tax

Q149: A cost system determines the cost of

Q167: Swansea Manufacturing currently produces 3,000 tires per

Q204: Anglico's most recent income statement is given