Whippany manufacturing wants to estimate costs for each product they produce at its Troy plant.The Troy plant produces three products at this plant,and runs two flexible assembly lines.Each assembly line can produce all three products.

Required:

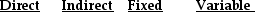

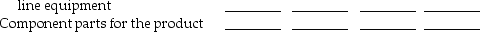

a.Classify each of the following costs as either direct or indirect for each product.

b.Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

Depreciation on the assembly

Wages of security personnel for the

Definitions:

Recognized

Acknowledged or understood, often referring to income, gains, or losses for tax purposes.

Distribution

Withdrawals or payouts from investments, retirement accounts, or revenue from a business that may be taxable.

Current Cash Distribution

In investments, it refers to the actual cash distributed to investors or partners from the operations of a business, fund, or another form of investment.

Partnership Interest

An owner's share of the profits and losses, and rights and obligations, in a partnership.

Q10: Under standard costing,there is no need to

Q18: 700 shirts are sold as seconds at

Q23: The seller of Product A has no

Q27: To simplify calculations under FIFO,spoiled units are

Q72: If the selling subunit is operating at

Q92: Which of the following is a learning-and-growth

Q106: The time from which a machine is

Q112: Indirect manufacturing costs _.<br>A)can be traced to

Q124: Accrual accounting rate of return is calculated

Q152: Fixed costs depend on the _.<br>A)amount of