Timekeeper Inc.manufactures clocks on a highly automated assembly line.Its costing system uses two cost categories,direct materials and conversion costs.Each product must pass through the Assembly Department and the Testing Department.Direct materials are added at the beginning of the production process.Conversion costs are allocated evenly throughout production.Timekeeper Inc.uses weighted-average costing.

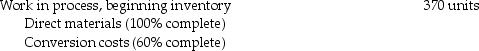

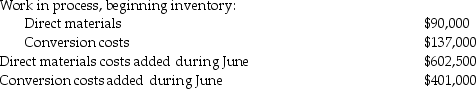

Data for the Assembly Department for June 2017 are:

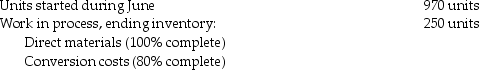

Costs for June 2017:

What are the equivalent units for direct materials and conversion costs,respectively,for June? (Round final answers to the nearest unit. )

Definitions:

Federal Income Tax

A tax levied by the federal government on an individual's or corporation's annual income.

Withholding Allowance

A provision allowing employees to reduce the amount of income tax withheld from their paycheck, based on their personal allowances and deductions.

Gross Earnings

Total income earned by an individual or entity before any deductions or taxes.

Withholding Allowance

A claim made by employees on their W-4 form indicating their tax situation to employers, affecting the amount of federal income tax withheld from their paychecks.

Q1: The Charmatz Corporation has a central copying

Q43: The Green Company processes unprocessed goat milk

Q47: Which of the following is true of

Q80: Which of the following is a reason

Q112: Separable costs include manufacturing costs only.

Q129: Which of the following statements is true

Q130: How does inspecting at various stages of

Q140: Weather Instruments assembles products from component parts.It

Q140: The Pitt Corporation has been outsourcing data

Q212: All costs reported on the income statement