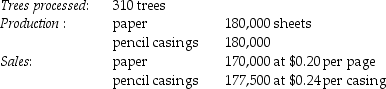

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) are obtained.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October:

The cost of purchasing 310 trees and processing them up to the split-off point to yield 180,000 sheets of paper and 180,000 pencil casings is $12,500.

Bismite's accounting department reported no beginning inventory.

What is the total sales value at the split-off point for paper?

Definitions:

Variable Costs

Costs that change in proportion to the activity of a business.

Property Taxes

Taxes levied by local governments based on the assessed value of property, including land and buildings owned.

Contribution Margin

The amount remaining from sales revenue after variable expenses have been deducted, indicating how much contributes to covering the fixed costs.

Break-even Sales

The amount of revenue needed to cover both fixed and variable costs, resulting in no profit or loss.

Q22: Which of the following is a storage

Q31: Cysco Corp has a budget of $1,210,000

Q40: In joint costing,outputs with no sales value

Q48: Alex is injured and rushed to Care

Q55: Which of the following companies is most

Q56: Pilgrim Corporation processes frozen turkeys.The company has

Q80: Which of the following is an advantage

Q83: Managers looking to reduce defective units produced

Q85: In joint costing,the sales value at split-off

Q139: Standard costing is NOT possible in a