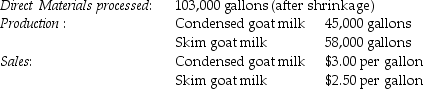

The Green Company processes unprocessed goat milk up to the split-off point where two products,condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 103,000 gallons of saleable product was $186,480.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 44,500 gallons (the remainder is shrinkage) of a medicinal milk product,Xyla,for an additional processing cost of $7 per usable gallon.Xyla can be sold for $25 per gallon.

Skim goat milk can be processed further to yield 56,700 gallons of skim goat ice cream,for an additional processing cost per usable gallon of $7.The product can be sold for $12 per gallon.

There are no beginning and ending inventory balances.

How much (if any) extra income would Green earn if it produced and sold skim milk ice cream from goats rather than goat skim milk? Allocate joint processing costs based upon the relative sales value at the split-off point.(Round intermediary percentages to the nearest hundredth. )

Definitions:

Peers

Individuals who are equals within a specific context, such as age, rank, or status.

Particular Situations

Specific circumstances or contexts that can influence behavior, decisions, or outcomes in a unique way.

Humanist Psychologists

Psychologists who emphasize individual potential for growth and the concept of free will, focusing on the study of the whole person.

Study Of Personality

The branch of psychology that focuses on understanding how individual differences in behavior, emotion, and thought patterns arise.

Q14: Jonathan has managed a downtown store in

Q35: A shift towards a higher proportion of

Q111: Comfort chair company manufacturers a standard recliner.During

Q119: Emerging Dock Company manufactures boat docks on

Q132: Distinguish between the two principal methods of

Q135: Timekeeper Inc.manufactures clocks on a highly automated

Q140: Weather Instruments assembles products from component parts.It

Q143: Which of the following is false regarding

Q149: Netzone Company is in semiconductor industry and

Q189: What are the five steps that are