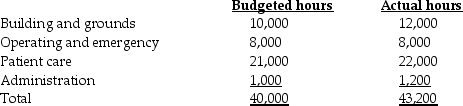

The fixed costs of operating the maintenance facility of General Hospital are $4,500,000 annually.Variable costs are incurred at the rate of $30 per maintenance-hour.The facility averages 40,000 maintenance-hours a year.Budgeted and actual hours per user for 2017 are as follows:

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Required:

a.If a single-rate cost-allocation method is used,what amount of maintenance cost will be budgeted for each department?

b.If a single-rate cost-allocation method is used,what amount of maintenance cost will be allocated to each department based on actual usage?

c.If a dual-rate cost-allocation method is used,what amount of maintenance cost will be budgeted for each department?

d.If a dual-rate cost-allocation method is used,what amount of maintenance cost will be allocated to each department based on actual usage? Based on budgeted usage for fixed operating costs and actual usage for variable operating costs?

Definitions:

Self-Serving Principles

Cognitive biases or behaviors that lead individuals to see things in a way that benefits them personally, often at the expense of others or the truth.

Socially Acceptable

Behaviors or norms that are considered appropriate and acceptable within a society or social group.

Inverse Function

A mathematical function that reverses another function, meaning if one function takes an input and gives an output, the inverse function takes this output back to the original input.

Affected People

Individuals who are influenced or impacted by a specific event, decision, or action.

Q4: Verer Custom Carpentry manufactures chairs in its

Q36: Dartmouth Building Products Inc.provides the following information.<br>Corporate

Q44: Silver Spoon Incorporated is a manufacturer of

Q47: Which of the following is true of

Q49: Cool Air Inc. ,manufactures single room sized

Q75: Which of the following statements is true

Q81: A company sells a software suite that

Q81: Outose Concept manufactures small tables in its

Q91: Which of the following best describes how

Q130: Timber logs are processed into standard lumber