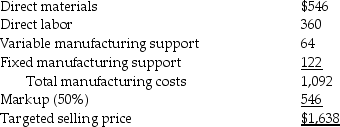

Kitchens Sales Inc.is approached by Mr.Louis Cifer,a new customer,to fulfill a large one-time-only special order for a product similar to one offered to regular customers.The following per unit data apply for sales to regular customers:

Kitchens Sales inc.has excess capacity.Mr.Cifer wants the cabinets in cherry rather than oak,so direct material costs will increase by $65 per unit.The average marketing cost of Kitchens Sales product is $175 per order.Which of the following costs is NOT considered to calculate the minimum acceptable price of a one-time-only special order?

Definitions:

Manufacturing Cost Elements

The components of manufacturing costs, typically including direct materials, direct labor, and manufacturing overhead.

Packaging Department

The division in a manufacturing firm responsible for packaging products for storage or shipment.

Baking Department

A specific department within a food manufacturing or retail business that is responsible for producing baked goods.

Process Cost Systems

Accounting methods used in industries where similar products are produced in a continuous process, allocating costs proportionally across all units produced.

Q15: McMurphy Corporation produces a part that is

Q16: Book value is defined as the _.<br>A)sum

Q20: Quick Connect manufactures high-tech cell phones.Quick Connect

Q46: Strategic Analysis of Profitability of King Philip

Q63: Which of the following statements is of

Q130: The advantages of the high-low method to

Q148: The static-budget variance is the difference between

Q162: Quantum Company uses the high-low method to

Q170: Gracius Manufacturing is approached by a European

Q200: For decision making,differential costs assist in choosing