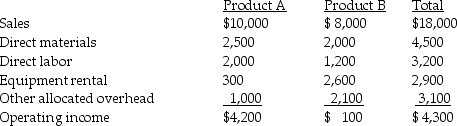

Biden Company sells two items,product A and product B.The company is considering dropping product B.It is expected that sales of product A will increase by 40% as a result.Dropping product B will allow the company to cancel its monthly equipment rental costing $200 per month.The other existing equipment will be used for additional production of product A.One employee earning $500 per month can be terminated if product B production is dropped.Biden's other fixed costs are allocated and will continue regardless of the decision made.A condensed,budgeted monthly income statement with both products follows:

Required:

Prepare an incremental analysis to determine the financial effect of dropping product B.

Definitions:

Standard Deviation

A statistical measure of the dispersion or variability of a set of data points, often used in finance to gauge the volatility of an investment.

Professional Portfolio Management

The disciplined practice of managing an investment portfolio by experts to achieve specific financial goals.

Low-Cost Diversification

An investment strategy that spreads investments across various assets to minimize risk without incurring high fees.

Specified Risk Level

A predefined degree of risk that an investment or portfolio is expected to adhere to.

Q46: In regression analysis,the term "goodness of fit"

Q47: Partial productivity multiplied by the quantity of

Q64: The account analysis method estimates cost functions

Q105: Rules for measurement and reporting for management

Q108: Engineered costs _.<br>A)have a no repetitive relationship

Q114: June Lockett,controller,gathered data on overhead costs and

Q120: The revenue effect of growth is calculated

Q171: Qualitative factors are outcomes that can be

Q173: Briefly describe the list of items that

Q189: When using the high-low method,the numerator of