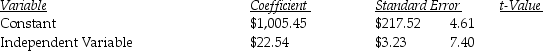

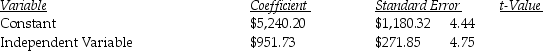

Ben and Mildred's Stables used two different independent variables (trainer hours and number of horses) in two different equations to evaluate the cost of training horses.The most recent results of the two regressions are as follows:

Trainer's hours:

R2 = 0.56

Number of horses:

R2 = 0.63

What is the estimated total cost for the coming year if 14,700 trainer hours are incurred and the stable has 310 horses to be trained,based upon the best cost driver?

Definitions:

Conversion Cost

The sum of direct labor and manufacturing overhead costs, representing the expense to convert raw materials into finished products.

Average Cost Method

An inventory costing method that calculates the cost of goods sold based on the average cost of all similar items in inventory.

Equivalent Unit

A measure used in cost accounting to express the amount of work done by manufacturers on units that are partially completed at the end of an accounting period.

Applied Overhead

The portion of overhead costs allocated to specific jobs or departments based on a predetermined rate.

Q2: Diiodine pentaoxide is used as an oxidizing

Q23: Financial accounting is broader in scope than

Q51: South Coast Appliance Store is a small

Q62: When using the high-low method,the two observations

Q77: Following a strategy of product differentiation,Izzy's Limited

Q105: Rules for measurement and reporting for management

Q119: The Connors Company has assembled the following

Q140: The controller is usually responsible for budgeting.

Q153: Put the following steps in order for

Q168: Cost accounting measures and reports short-term,long-term,financial,and non