Fresno Manufacturing Company specializes in the production of precision tools. Management is in the process of selecting a new drill press. The press under consideration will cost $92,000 plus necessary installation charges of $5,000. Experience indicates that the press will last for five years and should have a residual value at the end of that period of about $10,000. Expected annual cash revenues from the press should average $45,000, and related cash operating costs should be around $20,000. Management has decided on a minimum desired before-tax rate of return of 10 percent.

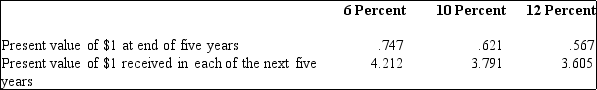

Present value multipliers:

a. Using before-tax information and the net present value method to evaluate this capital investment, determine whether the company should purchase the drill press. Support your answer.

b. If management has decided on a minimum desired before-tax rate of return of 12 percent, should the drill press be purchased? Show all computations to support your answer.

Definitions:

Femininity

A set of attributes, behaviors, and roles generally associated with girls and women, culturally defined in contrast to masculinity.

"Neutral" Toys

"Neutral" Toys are toys designed without gender stereotypes in mind, encouraging play and learning experiences for all children, regardless of their gender.

Cross-sectional

A research design that collects data from different individuals of different ages or developmental stages at a single point in time.

Longitudinal

A type of study or research design that follows the same subjects over a period of time to observe changes or developments.

Q7: An expression of the hourly labor pay

Q38: Which of the following forms of business

Q43: The formula used to compute budgeted total

Q45: Identify each of the following as quantitative

Q54: Which of the following is a characteristic

Q61: Murky Pharmaceuticals has issued preferred stock with

Q65: Keerin, Inc., produces a complete line

Q70: What does the agency problem refer to?<br>A)The

Q104: Variance analysis involves computing the difference between

Q106: The effectiveness of a performance management and