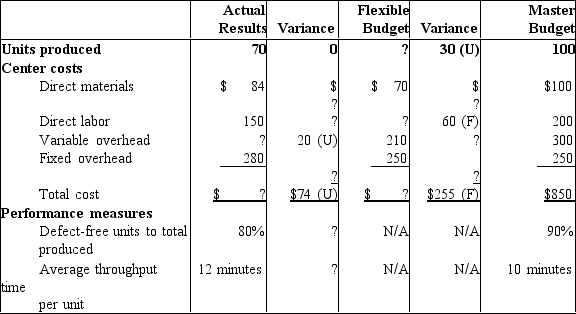

Use the following performance report for a cost center of the Dry Cat Food Division for the month ended December 31 to answer the question below.  What is the direct labor variance between the actual results and the flexible budget?

What is the direct labor variance between the actual results and the flexible budget?

Definitions:

Benefits Principle

A taxation theory suggesting that people should be taxed based on the benefits they receive from government services.

Progressive Tax

A tax system in which the tax rate increases as the taxable base amount increases, resulting in higher income individuals paying a larger percentage of their income in taxes compared to lower-income individuals.

Vertical Equity

A concept in taxation that argues taxpayers with a greater ability to pay taxes should pay more, compared to those with a lesser ability to pay.

Marginal Tax Rate

The tax rate that applies to the last dollar of the tax base (income or wealth) earned.

Q18: The FIFO approach to process costing assumes

Q30: Mi Casa Corporation wishes to prepare

Q44: Performance measurement is the use of both

Q58: Candidates for outsourcing would include<br>A) custodial services.<br>B)

Q60: A direct labor rate variance would occur

Q77: Activity-based costing is the tool used in

Q94: Cost of capital is the maximum desired

Q137: How can activity-based systems help managers in

Q143: The high-low method allows you to differentiate

Q147: Margin of safety is the excess of