Smith and Hodges Produce Notions for the Clothing Industry A Using T Accounts and Traditional Costing, Show the Flow

Smith and Hodges produce notions for the clothing industry. It uses four work cells for its four product lines. Just-in-time operations and costing methods have recently been adopted. A overhead rate of $9.50 per machine hour is applied to work cell #2. There were no beginning inventories on February 1. Operating costs for February for work cell #2 are as follows:

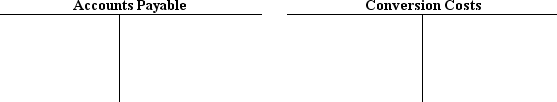

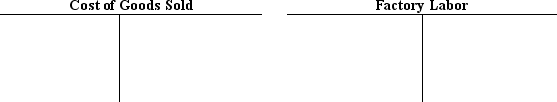

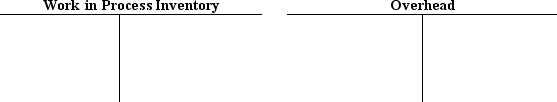

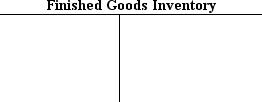

a. Using T accounts and traditional costing, show the flow of costs.

b. Using T accounts and a backflush costing system, show the flow of costs.

c. What is the total cost of goods sold for the month of February?

Definitions:

Average Variable Cost

The total variable cost divided by the quantity of output produced, representing the cost of producing one more unit.

Marginal Cost Curve

A graphical representation showing how the cost of producing one more unit of a good changes as production increases.

Industry Supply Curve

A graphical representation showing the relationship between the price of a good and the total output of the industry as a whole.

Price of An Input

The cost associated with purchasing goods or services used in the production process.

Q9: Variable costing allows a manager to classify

Q23: Cost traceability is decreased in a just-in-time

Q44: In a process costing system, each product

Q60: Salaries of supervisory production personnel should be

Q104: A framework for classifying value-adding and nonvalue-adding

Q107: The use of the FIFO method would

Q116: Given that the cost of goods manufactured

Q128: A work cell is an autonomous production

Q143: In accounting for an immaterial amount of

Q147: Margin of safety is the excess of