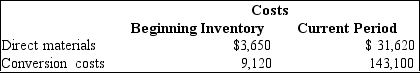

he Bakersfield Company has the following information available:  At the beginning of the period, there were 800 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 5,800 units were started and completed. Ending inventory contained 400 units that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO process costing method.)

At the beginning of the period, there were 800 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the current period, 5,800 units were started and completed. Ending inventory contained 400 units that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. (Assume that the company uses the FIFO process costing method.)

The total costs that will be transferred into the Finished Goods Inventory account during the current period are

Definitions:

Forensic Accounting

Forensic accounting is the specialization in accounting that focuses on investigating financial crimes and disputes, often involving legal matters, and preparing reports that can be used in court proceedings.

Financial Documents

Papers that contain important financial information, used for analysis, decision-making, or evidence.

Financial Misconduct

Unethical or illegal actions related to the management of finances, including fraud, embezzlement, and manipulation of accounts.

Cash Flow

The movement of money through an organization over a daily, weekly, monthly, or yearly basis.

Q14: As units are completed, their costs are

Q15: In a liquidation, partners are given back

Q18: The typical product costing system in a

Q18: A cost pool is a collection of

Q20: Distinguish between push-through and pull-through production methods.

Q49: Assume that the forecasted cost of goods

Q83: In process costing system, the average costing

Q87: Fill in the missing data for Company

Q107: The use of the FIFO method would

Q109: Distinguish between a supply chain and a