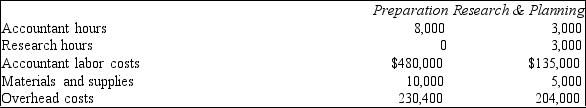

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns. The firm has five accountants and five researchers, and it uses job order costing to determine the cost of each client's return. The firm is divided into two departments: (1) Preparation and (2) Research & Planning. Each department has its own overhead application rate. The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours. The following is the company's estimates for the current year's operations.

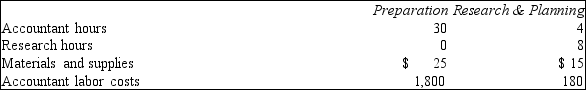

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

a. Compute the overhead rates to be used by both departments.

b. Determine the cost of Client No. 2006-713, by department and in total.

Definitions:

Duty of Care

A legal obligation to adhere to a certain standard of reasonable care while performing acts that could foreseeably harm others.

Bailment for Mutual Benefit

A legal relationship where personal property is transferred from one party to another, with both parties receiving a benefit.

Gratuitous Bailment

A bailment relationship where the bailee agrees to hold onto the bailor's property without receiving any compensation.

Treasure Trove

A category of found property consisting of money, coins, or precious items concealed by an unknown owner with the intent for rediscovery.

Q9: A company should use process costing rather

Q11: In a just-in-time environment, managing the production

Q16: Donovan invests $60,000 for a 30 percent

Q35: The costs of marketing and delivering a

Q39: An insurance company pays its employees a

Q53: Which one of the four levels of

Q72: The new Corina watch has an expected

Q86: Accumulating, interpreting, and reporting financial information is

Q111: Direct materials for 8,000 units were added

Q158: Explain what cost-volume-profit analysis is and how