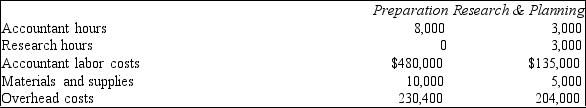

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns. The firm has five accountants and five researchers, and it uses job order costing to determine the cost of each client's return. The firm is divided into two departments: (1) Preparation and (2) Research & Planning. Each department has its own overhead application rate. The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours. The following is the company's estimates for the current year's operations.

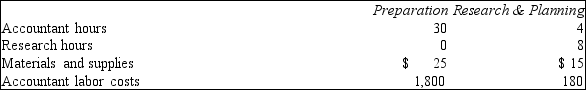

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

Client No. 2006-713 was completed during April of the current year and incurred the following costs and hours:

a. Compute the overhead rates to be used by both departments.

b. Determine the cost of Client No. 2006-713, by department and in total.

Definitions:

Allocation Base

A criterion or standard used to distribute costs among different cost objects, such as departments or products.

Overhead Costs

Indirect costs incurred in the business process, such as rent, utilities, and administrative expenses, not directly attributable to specific products or services.

Complex

Consisting of many different and connected parts; not simple.

Plantwide Overhead Rate

A single, uniform overhead absorption rate used throughout a manufacturing plant or facility.

Q1: Although some management accountants strive to update

Q4: The entities forming joint ventures usually involve

Q20: The index number used in trend analysis

Q23: If a partnership agreement does not specify

Q73: During March, Department A started 300,000 units

Q83: In a just-in-time environment,<br>A) production runs are

Q99: When M purchases N's $10,000 capital interest

Q100: Market strength is the ability to increase

Q121: Partners R and S receive a salary

Q124: Total manufacturing costs increase which of the