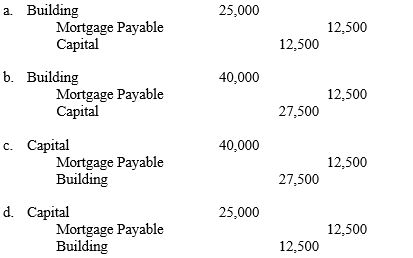

A partner invests into a partnership a building with a $25,000 carrying value and $40,000 fair market value. The related mortgage payable of $12,500 is assumed by the partnership. The entry to record the investment in partnership is:

Definitions:

Accruals

An accounting practice that documents income and expenditures at the time they happen, irrespective of the timing of the associated cash transactions.

Recorded

The act of documenting transactions, changes, or events in the relevant books or databases for future reference and analysis.

Incurred

Refers to costs or expenses that have been realized or consumed in the operation of a business, often indicating that an economic event affecting the company's finances has taken place.

Depreciates

The process by which the value of an asset decreases over time, usually due to wear and tear or obsolescence.

Q16: Why is the quick ratio probably better

Q27: Which of the following must be reported

Q42: Financial accounting usually involves analyses of various

Q45: Assume that the balance of accounts payable

Q47: Only not-for-profit organizations form joint ventures.

Q52: Noncash investing and financing transactions<br>A) appear as

Q59: Use the following information to obtain the

Q78: Liabilities related to assets invested in a

Q123: A partner who invests assets into a

Q127: Which of the following does not result