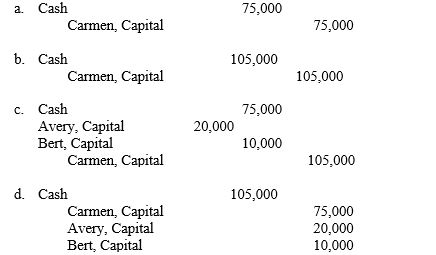

Avery and Bert are partners who share profits and losses in a ratio of 2:1 and have capital balances of $75,000 and $150,000, respectively. The partners agree to admit Carmen to the partnership. Carmen invests $75,000 for a 35 percent interest in the partnership. The new total capital balance after admitting Carmen is $300,000. The entry to record the admission of Carmen to the partnership is:

Definitions:

Q3: The interest coverage ratio and the debt

Q19: Total estimated overhead costs should be divided

Q58: A 20 percent change in net sales

Q76: Kelly invests $40,000 for a 10 percent

Q95: The following information pertains to Jasmin Corporation.

Q99: When M purchases N's $10,000 capital interest

Q119: Which of the following would not affect

Q124: Which of the following would be used

Q153: The quality of a company's earnings may

Q167: A debit balance in Deferred Income Taxes