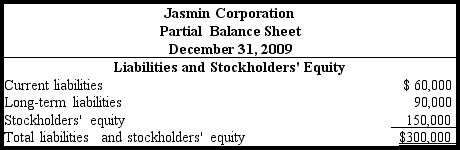

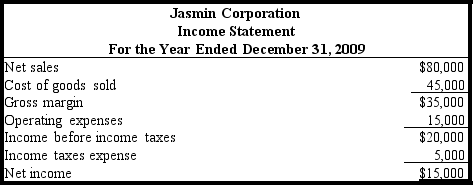

The following information pertains to Jasmin Corporation. Assume that all balance sheet amounts represent both average and ending figures.

Jasmin Corporation had 6,000 shares of common stock issued and outstanding. The market price of Jasmin common stock on December 31, 2009, was $20. Jasmin paid dividends of $0.90 per share during 2009.

Jasmin Corporation had 6,000 shares of common stock issued and outstanding. The market price of Jasmin common stock on December 31, 2009, was $20. Jasmin paid dividends of $0.90 per share during 2009.

What is the return on equity for this corporation? Round your answer to 1 decimal place.

Definitions:

Possible

Capable of happening, existing, or being true without contradiction within a given context.

Ought

Expresses a sense of duty, obligation, or appropriateness, often linked to moral or societal standards.

Ideal Self

A person's concept of how they would like to be, encompassing their goals, aspirations, and standards of perfection.

Actual Self

Refers to an individual's perception of themselves as they are, in contrast to how they might wish to be or believe they should be.

Q1: Financial leverage is also known as trading

Q15: Financial statements for Cancun Corporation are presented

Q41: Royer Corporation engaged in this transaction: Transferred

Q79: The management accountant who is responsible only

Q90: The sale of plant assets and the

Q94: A partner will not bind the partnership

Q108: Most companies issue interim financial statements to

Q115: Claim to the partners' personal assets by

Q147: Book value per share of stock represents

Q174: The consistency convention requires that<br>A) a company