Dennis Corporation entered into a long-term lease for a piece of equipment. The lease term calls for an annual payment of $2,000 for six years, which approximates the useful life of the equipment. Assume a discount factor of 16 percent. (Note: Present value of a single sum factor at six years and 16% is 0.410; present value of an annuity factor at six years and 16% is 3.685.) Round answers to the nearest dollar.

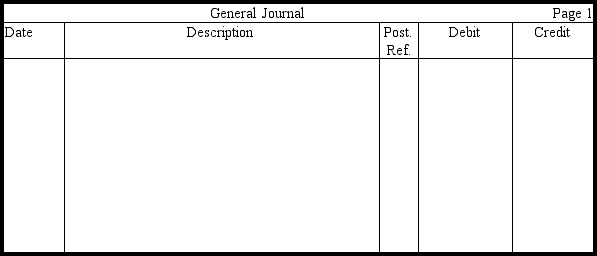

a. Prepare the entry without explanation to record the leased equipment.

b. Prepare the entry without explanation to record annual depreciation, assuming the straight-line method and no residual value.

c. Prepare the entry without explanation to record the first annual payment of $2,000, after the company has had the equipment for one year.

Definitions:

Q11: If the purchase of machinery is treated

Q35: When presenting decreases in long-term investments in

Q39: Why must a corporation have sufficient retained

Q47: Royer Corporation engaged in this transaction: Received

Q56: Paloma Corporation had 5,000 shares of $100

Q58: One disadvantage of a corporation is the

Q105: The cost of assets acquired for a

Q107: The entry that includes a debit to

Q147: When the effective interest method of amortization

Q227: The following machines were purchased during 2010