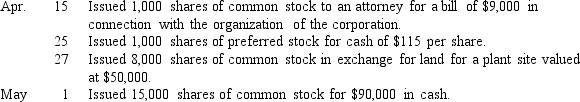

Brandt Corporation is authorized to issue 100,000 shares of $5 stated value common stock and 2,000 shares of $100 par value, 8 percent preferred stock. Prepare entries in journal form without explanations to record the following transactions:

Definitions:

Tax Amount

The total sum of money required by a government from individuals or businesses as a form of revenue.

Deadweight Loss

A loss of economic efficiency that can occur when the free market equilibrium for a good or a service is not achieved.

Excise Tax

A tax charged on specific goods, services, and activities, such as gasoline, alcohol, and gambling.

Tax Burden

The impact of taxation on an individual or entity, often measured as a proportion of income or revenue.

Q16: It is considered unethical to use the

Q22: Fiona Corporation has a 7 percent, $600,000

Q27: A corporation is a separate entity for

Q35: A 2-for-1 stock split will have the

Q48: During July, Audio City sold 200 radios

Q72: The number of shares of issued stock

Q83: Failure to record depletion for a given

Q93: Hatley Corporation borrowed $10 million to finance

Q96: Any unamortized bond discount should be reported

Q127: An expenditure for which of the following