Bob Quinn is in the gravel business and has engaged you to assist in evaluating his company, Quinn Gravel Company. Your first step is to collect the facts about the company's operations. On January 3, 2010, Bob purchased a piece of property with gravel deposits for $3,155,000. He estimated that the gravel deposits contained 4,700,000 cubic yards of gravel. The gravel is used for making roads. After the gravel is gone, the land, which is in the desert, will be worth only about $100,000.

The equipment required to extract the gravel cost $726,000. In addition, Bob had to build a small frame building to house the mine office and a small dining hall for the workers. The building cost $76,000 and will have no residual value after its estimated useful life of ten years. It cannot be moved from the mine site. The equipment has an estimated useful life of six years (with no residual value) and also cannot be moved from the mine site.

Trucks for the project cost $154,000 (estimated life, six years; residual value, $10,000). The trucks, of course, can be used at a different site.

Bob estimated that in five years all the gravel would be mined and the mine would be shut down. During 2010, 1,175,000 cubic yards of gravel were mined. The average selling price during the year was $1.33 per cubic yard, and at the end of the year 125,000 cubic yards remained unsold. Operating expenses were $426,000 for labor and $116,000 for other expenses.

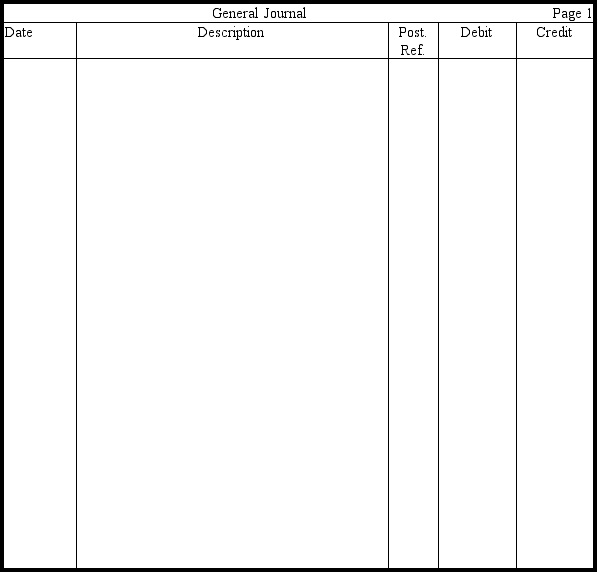

a. Prepare adjusting entries to record depletion and depreciation for the first year of operation (2010). Assume that the depreciation rate is equal to the percentage of the total gravel mined during the year, unless the asset is movable. For movable assets, use the straight-line method. (Omit explanations.)

b. Prepare an income statement for 2010 for Quinn Gravel Company.

c. What is your evaluation of the company's operations? Explain your evaluation and offer suggestions. Ignore income tax effects.

Definitions:

Active Transport

The movement of molecules across a cell membrane from a region of lower concentration to higher concentration, requiring energy.

Facilitated Diffusion

A process of passive transport, as opposed to active transport, where molecules move across a membrane with the assistance of transport proteins, without energy expenditure.

Eggshell Membrane

The thin layer between the eggshell and the egg white, rich in protein and collagen, often used in dietary supplements and cosmetic products.

Albumin

A protein found in blood plasma that helps maintain osmotic pressure and transport substances.

Q11: The allowance for uncollectible accounts is similar

Q16: Total payroll for a given week is

Q97: Which of the following would not be

Q100: A company purchases land and a building

Q114: A contract limiting the rights of others

Q115: The direct charge-off method makes not attempt

Q130: The cost of tearing down a building

Q151: An asset purchased according to a deferred

Q176: Because accounting measures should be verifiable, liabilities

Q201: Which of the following is not a