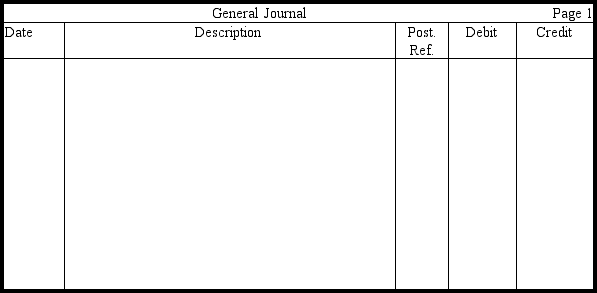

Assuming that the allowance method is being used, prepare journal entries to record the following transactions. Omit explanations.

Mar. 15 Sold merchandise to Faust for $6,000 on account.

Apr. 15 Received $3,000 from Faust.

Aug. 15 Wrote off Faust's account as uncollectible.

Nov. 15 Unexpectedly received payment in full from Faust.

Definitions:

Leasehold Estate

The creation of an ownership interest in the tenant. An interest in real estate that is held under a lease. Also called tenancy.

Life Estate

An estate in which the owner owns real property for his or her life or for the life of another.

Reversion Estate

A future interest in property when title is to return to the grantor or grantor’s heirs upon expiration of a life estate.

Tenancy In Common

A form of joint ownership of property where each owner holds a percentage interest that can be sold or inherited independently of the others.

Q5: Use this information to answer the

Q36: Use this information to answer the following

Q55: Use this information to answer the

Q59: Chancellor Company purchased merchandize worth $900 on

Q80: Indicate whether each of the following expenditures

Q113: Use this information to answer the following

Q146: The higher the inventory turnover, the higher

Q159: The main difference between intangible assets and

Q160: A petty cash fund is an example

Q177: The classification of a liability as current