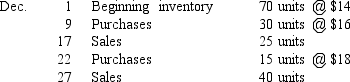

Use the following information to calculate ending inventory on (a) a LIFO basis, (b) a FIFO basis, and (c) an average-cost basis. Assume a perpetual inventory system.

Definitions:

Net Advantage to Leasing

A financial analysis metric that compares the costs of leasing to the costs of purchasing an asset, enabling businesses to determine the most cost-effective financing option.

CCA Class

refers to the Capital Cost Allowance Class, a categorization used in Canadian tax to determine the depreciation rate for tax purposes on assets.

Annual Depreciation

The method of allocating the cost of a tangible asset over its useful life on a yearly basis.

Cost of Debt

The effective rate that a company pays on its total debt, reflecting the expense of borrowing funds.

Q10: Illegal acts of a small dollar amount

Q35: The balance of Accounts Receivable, net of

Q37: If the amount of uncollectible accounts expense

Q53: When the cost of inventory is written

Q64: Freight paid on goods shipped to customers

Q68: On a multistep income statement, other revenues

Q98: Which of the following account names should

Q105: When a U.S. company does business with

Q155: All of the following are measures of

Q172: Why do businesses need to keep some