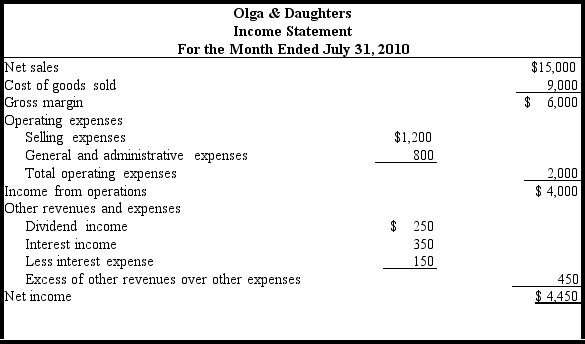

Use the information from the following multistep income statement to prepare a single-step income statement in proper form.

Definitions:

Accrual-Basis Accounting

An accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when the cash is received or paid.

Deferred Revenue

Income received by a company for goods or services yet to be delivered or performed, recognized as a liability until the obligation is fulfilled.

Unearned Rent

is income received by a landlord for rent that has been paid in advance by a tenant but has not yet been earned.

Adjust Revenue

The act of modifying the reported amount of revenue to more accurately reflect the earnings of a period, following certain accounting principles and standards.

Q9: Under a perpetual inventory system, is it

Q24: Use this inventory information for the month

Q31: After all closing entries have been entered

Q33: Which of the following accounting conventions would

Q35: A trial balance is normally prepared at

Q36: Which of the following events does not

Q48: The use of a cash register would

Q54: Using the following amounts taken from

Q84: Using the following information, calculate for 2010

Q141: Which of the following accounts probably would