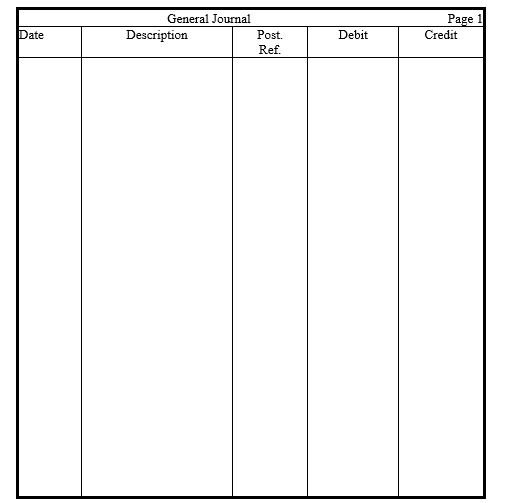

Prepare year-end adjusting entries for each of the following situations.

a. The Office Supplies account showed a beginning debit balance of $600 and purchases of $1,000. The ending debit balance was $400.

b. Depreciation on buildings is estimated to be $7,600.

c. A one-year insurance policy was purchased for $6,000. Four months have passed since the purchase.

d. Accrued interest on notes payable amounted to $1,500.

e. The company received a $14,400 advance payment during the year on services to be performed. By the end of the year, two-thirds of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $14,000. The last day of the period is a Wednesday.

g. Services totaling $780 had been performed but not yet billed or recorded.

Definitions:

Employment Setting

Refers to the place or context in which employment occurs, including physical locations, organizational environments, and remote or virtual workplaces.

Bilateral Contract

A bilateral contract is an agreement in which each of the two parties makes a promise to the other, creating mutual obligations.

Consideration

In contract law, a benefit or something of value that is exchanged between parties to a contract, making the agreement legally binding.

Contracting Party

An entity or individual that enters into a legal contract or agreement.

Q3: Use this information to answer the following

Q24: The terms bookkeeping and accounting are synonymous.

Q72: Which measurement below represents the heaviest mass?<br>A)1

Q111: One can obtain a clear picture of

Q125: Office supplies become expenses<br>A) when they are

Q150: Revenue cannot be recognized unless delivery of

Q160: Which of the following accounts has a

Q161: Which of the following accounts has a

Q161: Expenses are incurred<br>A) to generate revenue.<br>B) to

Q182: In the journal provided, prepare journal entries