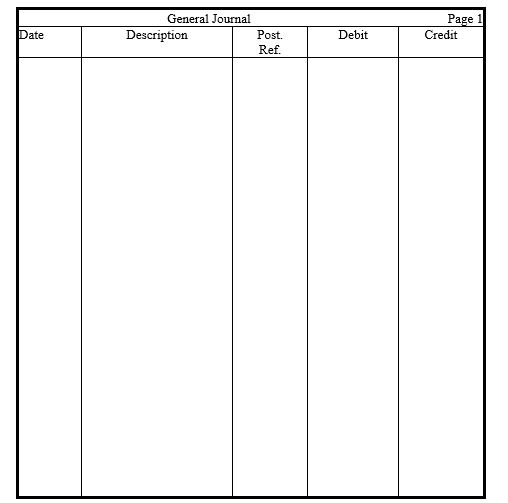

Prepare year-end adjusting entries for each of the following situations:

a. The Store Supplies account showed a beginning debit balance of $400 and purchases of $2,800. The ending debit balance was $800.

b. Depreciation on buildings is estimated to be $7,300.

c. A one-year insurance policy was purchased for $2,400. Nine months have passed since the purchase.

d. Accrued interest on notes payable amounted to $200.

e. The company received a $9,600 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $10,000. The last day of the period is a Tuesday.

g. Services totaling $920 had been performed but not yet billed or recorded.

Definitions:

Active

Engaging or ready to engage in physically energetic pursuits; not passive.

Sociocultural Influences

The forces of society and culture that shape individuals' beliefs, habits, and lifestyles.

Human Development

The process of growth and change that takes place over the course of a human life, encompassing physical, cognitive, social, and emotional development.

Q17: Current assets divided by current liabilities is

Q37: When there is no direct connection between

Q58: The number 4,450,000.0 has 3 significant figures.

Q62: Why is the Owner's Withdrawals account increased

Q70: The principal difference between depreciation expense and

Q104: Closing entries will<br>A) decrease the owner's Capital

Q110: The prefix micro represents the multiplier 0.001.

Q115: Although a stapler that costs $10 is

Q119: Which of the following accounts is an

Q160: Which of the following pairs of accounts