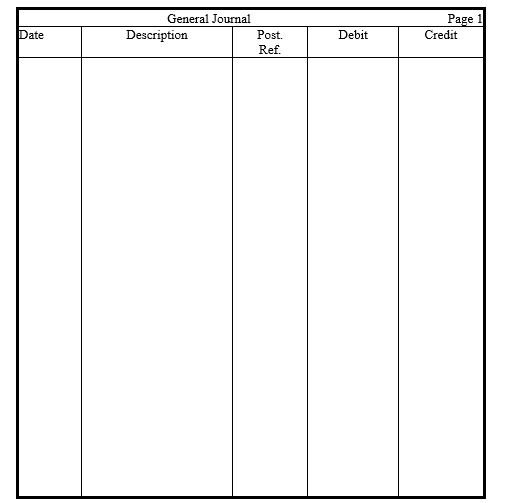

Prepare year-end adjusting entries for each of the following situations.

a. The Office Supplies account showed a beginning debit balance of $600 and purchases of $1,000. The ending debit balance was $400.

b. Depreciation on buildings is estimated to be $7,600.

c. A one-year insurance policy was purchased for $6,000. Four months have passed since the purchase.

d. Accrued interest on notes payable amounted to $1,500.

e. The company received a $14,400 advance payment during the year on services to be performed. By the end of the year, two-thirds of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $14,000. The last day of the period is a Wednesday.

g. Services totaling $780 had been performed but not yet billed or recorded.

Definitions:

Income Effect

The change in an individual's or economy's consumption patterns due to a change in real income, which can result from wage changes, inflation, or taxation adjustments.

Consumer Equilibrium

The point at which the quantity of a product demanded by consumers equals the quantity supplied, leading to a state where there is no incentive for prices to change.

Consumer Equilibrium

A state in which a consumer has allocated their income in a way that maximizes their total utility given the prices of goods and services.

Substitution Effect

The change in consumption patterns due to a change in the relative prices of goods, leading consumers to replace more expensive items with cheaper alternatives.

Q3: Use this information to answer the following

Q8: Bill Pierce owns several ice cream shops

Q27: Molecules are responsible for scattering light which

Q68: Accounts Receivable was $750 at the end

Q74: The owner's Capital, Withdrawals, and Income Summary

Q96: Determine the answer for the equation below

Q124: Which of the following accounts is classified

Q144: A depreciable asset's original cost can typically

Q149: Knowledge of the exchange rate is necessary

Q162: An adjusting entry made to record accrued