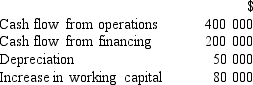

Using the following information,calculate net operating profit after tax.

Definitions:

Gross Profit

Gross Profit is the financial metric representing the difference between revenue and the cost of goods sold (COGS), before deducting overheads, payroll, taxation, and interest payments.

Periodic Inventory System

An inventory accounting system where updates to inventory levels are made on a periodic basis, rather than continuously, often at the end of an accounting period.

Cost Of Goods Sold

The direct costs attributable to the production of goods sold by a company.

Merchandising Business

A merchandising business buys goods in their finished form for the purpose of resale without further processing, making profit through buying and selling activities.

Q1: The net profit reported on the profit

Q4: What was the value of ending inventory

Q13: <br>An electricity account was paid.There was no

Q14: Which of the following would be increased

Q15: Which of the following errors,each considered individually,would

Q24: Using the percentage of completion method,what profit

Q32: Which of the following entries records a

Q38: What was the value of ending

Q74: In an electrochemical cell,which of the following

Q80: Which type of particle can be emitted