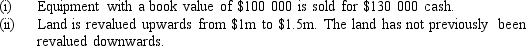

Consider the following transactions:  Which of the above transactions increases profits?

Which of the above transactions increases profits?

Definitions:

Unit Product Cost

The cost associated with producing a single unit of product, including direct materials, direct labor, and allocated overhead expenses.

Net Operating Income

A company's operating profit after subtracting all operating expenses but before interest and taxes, reflecting the profitability of the core business activities.

Absorption Costing

A technique in accounting where all costs incurred from manufacturing, like direct materials, direct labor, and both kinds of manufacturing overhead (variable and fixed), are factored into the product's pricing.

Unit Product Cost

The total cost incurred to produce, bundle, and ready one unit for sale, including both direct and allocated overhead costs.

Q4: In preparing a bank reconciliation statement for

Q16: What difference would there be to the

Q18: In reporting on its liability for long

Q23: What was the number of days' inventory

Q29: Marion Company had these transactions during the

Q32: How much profit was earned during 2015

Q34: A liability should only be recognised in

Q43: What is the current ratio following the

Q62: A business purchases inventory for $220,paying $50

Q85: What is the name of the following