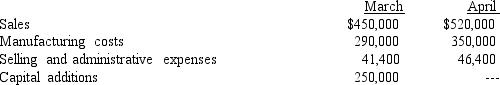

The treasurer of Unisyms Company has accumulated the following budget information for the first two months of the coming year:

The company expects to sell about 35% of its merchandise for cash.Of sales on account,80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale.One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month.Depreciation,insurance,and property taxes represent $6,400 of the probable monthly selling and administrative expenses.Insurance is paid in February,and a $40,000 installment on income taxes is expected to be paid in April.Of the remainder of the selling and administrative expenses,one-half are expected to be paid in the month in which they are incurred,with the balance paid in the following month.Capital additions of $250,000 are expected to be paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000.Current liabilities as of March 1 are composed of accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses).Management desires to maintain a minimum cash balance of $20,000.

Prepare a monthly cash budget for March and April.

Definitions:

Majority Shareholder

An individual or entity owning more than 50% of a company's shares, giving them significant control over the company's decisions.

Close Corporation

A type of corporation characterized by a small number of shareholders, no public market for its shares, and often operated similarly to a partnership.

Transferability

The ability of an asset to be transferred or made over from one party to another.

Close Corporation

A privately held company characterized by a small number of shareholders with no public market for its shares.

Q6: An anticipated purchase of equipment for $1,200,000,with

Q11: A production supervisor's salary that does NOT

Q17: In E.coli,base-pairing between an mRNA's _ and

Q33: As production increases,what should happen to the

Q49: Merle Company manufactures two models of microcassette

Q73: A series of unequal cash flows at

Q89: The sales,income from operations,and invested assets for

Q94: One issue to consider when investing in

Q107: Assume that Crowson Co.sold 8,000 units of

Q137: Which transfer price approach is used when