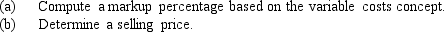

Kirk Co.manufactures mobile cellular equipment and develops a price for the product by using a variable cost concept.Kirk incurs variable costs of $1,900,000 in the production of 100,000 units.Fixed costs total $50,000.The company employs $4,725,000 of assets and wishes to earn a profit equal to a 10% rate of return on assets.

Definitions:

Payroll Tax Expense

Financial charges imposed on employers based on the wages and salaries paid to employees.

FICA Taxes Payable

Liabilities owed for Social Security and Medicare taxes, which are shared by employees and employers, and must be remitted to the government.

Pension Rights

Entitlements or benefits that an employee accumulates from a pension plan, providing income upon retirement.

Vacation Privileges

Vacation privileges refer to the policy and benefits related to employees' eligibility and entitlement to take paid time off for personal rest, travel, or leisure.

Q6: An anticipated purchase of equipment for $1,200,000,with

Q18: Depreciation on a yearly basis differs between

Q40: Knowing how costs behave is useful to

Q40: Which of the following is usually NOT

Q48: Methods that ignore present value in capital

Q55: If net income is $130,000 and interest

Q82: The manager of a profit center does

Q86: The range of activity over which changes

Q95: Assume that Division X has generated sales

Q131: The objective of transfer pricing is to