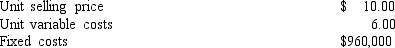

Vest Food Co.has the following operating data:

The company is contemplating moving to another state where direct labor costs can be reduced,thereby reducing the unit variable cost by 10%.The state where the company currently operates has offered to reduce property taxes to encourage Vest to stay.The minimum amount of property tax savings necessary to keep the company,assuming no other changes,would be

Definitions:

Business Letter

A formal document used for communication between companies or between a company and its clients, suppliers, or other stakeholders.

Closing

In business, refers to the final steps in completing a transaction or deal; in medicine, it can refer to the suturing or sealing of a wound or surgical incision.

Return-To-Work

A program or policy designed to help employees transition back to work after an illness, injury, or medical leave.

Medical Office

A workplace for healthcare professionals where patients receive outpatient medical services and consultations.

Q20: A manufacturing business converts materials into finished

Q47: The variable cost per unit remains constant

Q62: Which of the following would most likely

Q89: Most employers are required to withhold federal

Q96: The total factory overhead cost variance is<br>A)$3,900

Q97: The Crawford Company forecasts that total overhead

Q99: If the cost of direct materials is

Q107: Property tax expense for a department store's

Q134: In preparing flexible budgets,the first step is

Q149: Financial reporting systems that are guided by