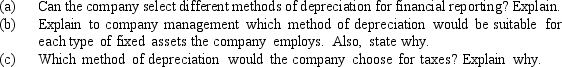

You have been hired by a high-growth startup company to assist in the determination of what depreciation method to employ for financial reporting.The company's fixed assets are equally divided among buildings and high-tech equipment (heavily used in the initial years).

Definitions:

Variable Overhead

Costs of production that vary with the level of manufacturing activity or output, such as utilities and commissions, as opposed to fixed overhead costs.

Rate Variance

The difference between the actual rate paid for inputs and the standard rate expected, often related to labor or manufacturing overhead.

Overhead Applied

The process of allocating overhead costs to specific cost objects, such as products or jobs, based on a predetermined rate or method.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products or job orders, calculated before the production period begins.

Q13: Thomson Company reported the following on its

Q23: Current liabilities are<br>A)due but not receivable for

Q24: The ratio computed by dividing current assets

Q37: The removal of an old building to

Q40: Materials are transferred from the storeroom to

Q62: Cost is a method of inventory valuation.

Q63: Based on Washington's current ratio,which of the

Q64: Which transaction would be recorded in a

Q71: Increases in the Work in Process account

Q95: A&M Co.provided services of $1,000,000 to clients