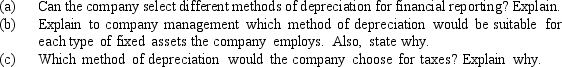

You have been hired by a high-growth startup company to assist in the determination of what depreciation method to employ for financial reporting.The company's fixed assets are equally divided among buildings and high-tech equipment (heavily used in the initial years).

Definitions:

Return on Total Assets

A financial ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets, indicating how efficiently a company uses its assets to generate earnings.

Net Income Before Interest and Taxes

Earnings of a company before interest and tax expenses are deducted; also known as operating profit.

Accounts Receivable Turnover

A financial metric that measures how many times a company collects its average accounts receivable in a period, indicating the efficiency of extending credit and collecting debts.

Average Accounts Receivable

The average amount of money owed to a company by its customers for goods or services provided on credit over a specified period.

Q5: A 60-day,10% note for $6,000 dated April

Q9: Which of the following are subtracted from

Q34: If merchandise sold on account is returned

Q34: If the current credit terms are 2/10,n/30

Q43: Job order cost systems can be used

Q51: A special cash fund used to make

Q56: Which of the following is NOT an

Q62: On the bank's accounting records,customers' accounts are

Q67: Expenses that are incurred directly or entirely

Q87: Using the indirect method for preparing the