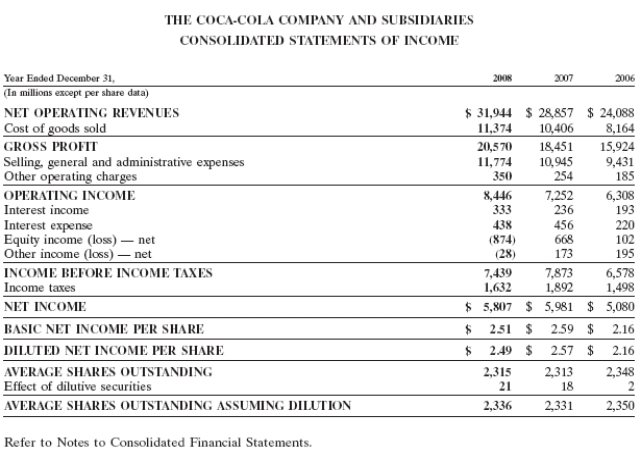

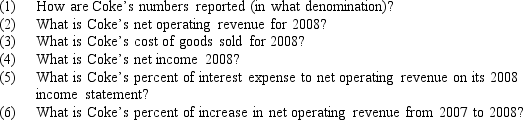

-Review Coke-Cola's financial statements and answer the following questions:

Definitions:

Exchange-Rate Risk

The potential for investors to experience losses due to changes in the exchange rate between two currencies in their foreign investment transactions.

World-Index Portfolio

An investment portfolio comprising a wide variety of assets that aim to mirror the performance of global financial markets or specific global indexes.

Single-Country Funds

Investment funds that target securities from a specific country, offering exposure to that nation’s economic performance.

Mutual Funds

Investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Q4: Refer to Exhibit 2-1.What is net income,assuming

Q7: Based on the following data,determine the cost

Q21: The debt created by a business when

Q46: All executive compensation must be:<br>A)Maintained in a

Q61: Which of the following is a payroll

Q62: What is a use of a firm's

Q69: If title to merchandise purchases passes to

Q82: Merchandise with an invoice price of $6,000

Q113: Which of the following should be shown

Q142: Sales returns are granted by the seller