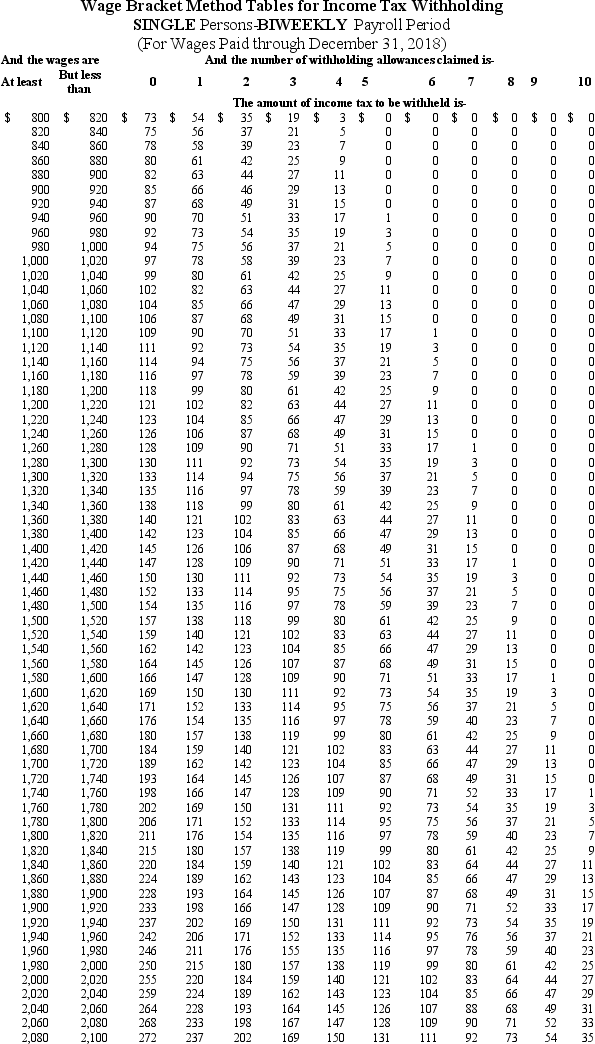

Caroljane earned $1,120 during the most recent pay biweekly pay period.She contributes 4% of her gross pay to her 401(k) plan.She is single and has 1 withholding allowance.Based on the following table,how much Federal income tax should be withheld from her pay?

Definitions:

Managerial Decisions

The choices made by the management of a company regarding the direction, operation, and strategy of the organization to achieve its objectives.

Product Costing

The process of determining the total costs involved in producing a product, including materials, labor, and overhead.

Product Constraints

Limitations or restrictions on the production process, such as capacity issues or material shortages, potentially impacting output and efficiency.

Product Line

A group of related products offered by a company that serve a similar need or are marketed under a single brand.

Q2: The Consolidated Appropriations Act included an increase

Q4: The payroll tax(es)for which an employer must

Q24: What is an advantage of direct deposit

Q27: The difference between the federal minimum wage

Q29: Paying expenses affects which financial statement elements?<br>A)Assets

Q32: _ is the price that a person

Q35: Current financial reporting standards assume that users

Q36: The accrual basis of accounting recognizes<br>A)revenues when

Q44: Employers benefit by offering POPs because they

Q45: Which of the following is among the