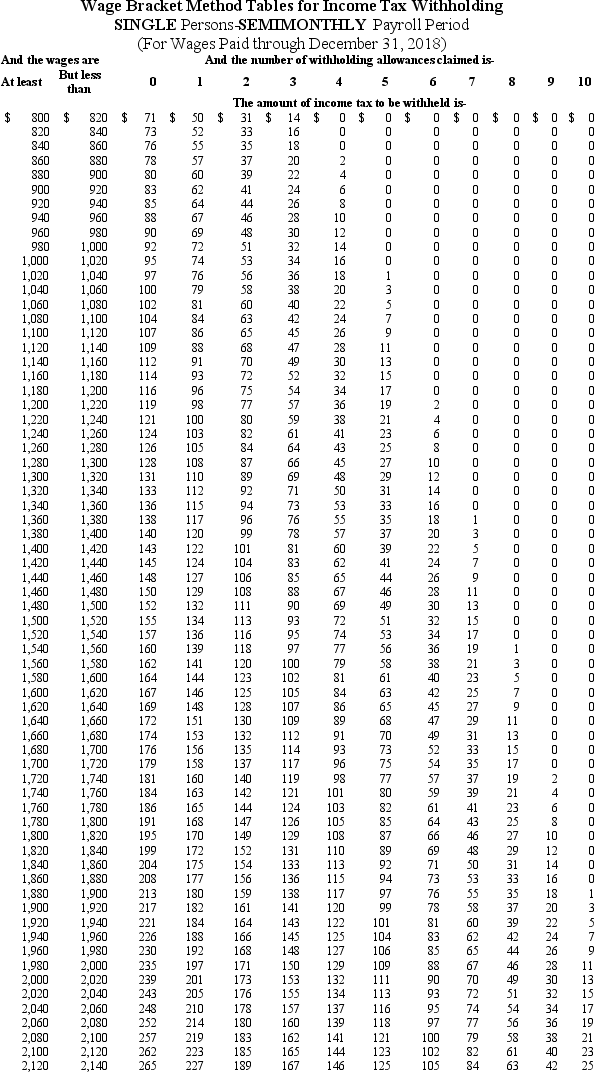

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k) plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table) ?

Definitions:

Long-arm Statutes

refer to laws that allow for the service of process beyond a state's borders to non-resident defendants under specific circumstances.

Minimum Contacts

A legal principle that determines the ability of a court to exercise jurisdiction over parties based on their connection to the location where the court is established.

Jurisdiction

The official power to make legal decisions and judgments, often within a specific geographic area or over certain types of legal cases.

Defendant

The party against whom a legal action is brought in a court of law.

Q16: Under the Affordable Care Act,what are the

Q18: Declaring and paying cash dividends affects which

Q21: Eagle Eye,Inc. ,a corporation,received an additional investment

Q34: What does it mean to prove the

Q34: Which of the following would not be

Q34: Charitable contributions are an example of post-tax

Q35: When journalizing the employees' pay accrual,the _

Q35: Which of the items below is NOT

Q60: Bruce is a nonexempt employee at Grissom

Q72: The Stockholders' Equity of a company should