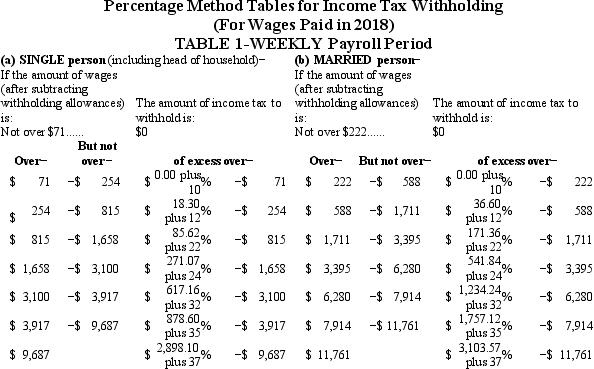

Olga earned $1,558.00 during the most recent weekly pay period.She is single with 2 withholding allowances and no pre-tax deductions.Using the percentage method,compute Olga's federal income tax for the period.(Do not round intermediate calculations.Round final answer to 2 decimal places. )

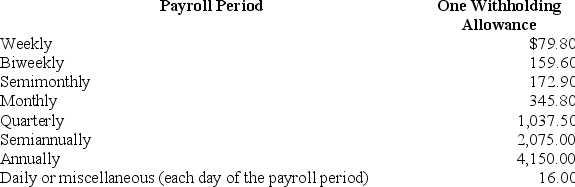

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Definitions:

Diffuse

To spread or cause to spread over a wide area or among a large number of people.

Specific

refers to something clearly defined or identified, often used to describe a particular detail, requirement, or characteristic.

Power Tactics

Strategies and techniques deployed by individuals or groups to manipulate or influence others to gain authority or achieve goals.

Unilateral Vs. Bilateral

Describes two types of relationships or agreements; unilateral involves one party or side only, whereas bilateral involves mutual or reciprocal action from two parties or sides.

Q14: The percentage method of determining an employee's

Q20: Which of the following accounts is a

Q29: Accounting is thought to be the "language

Q30: Leslie is the accountant for a major

Q35: Refer to Donald Duck Co.How much cash

Q47: Francesca earns $2,400 per pay period.Compute the

Q60: The factors that determine an employee's federal

Q66: According to the Fair Labor Standards Act,nonexempt

Q81: On May 31,2010,Deana's Services Company had account

Q84: The unearned rent account has a balance