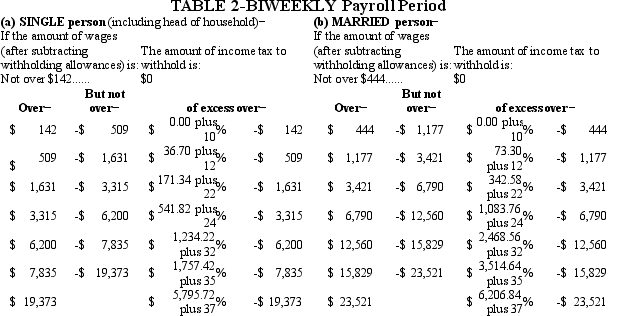

Warren is a married employee with six withholding allowances.During the most recent biweekly pay period,he earned $9,450.00.Using the percentage method,compute Warren's federal income tax.(Do not round intermediate calculations.Round your final answer to 2 decimal places. )

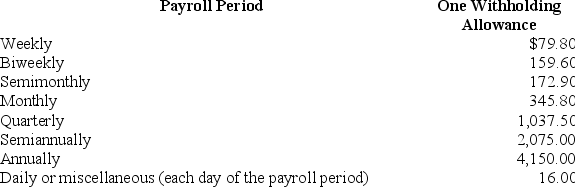

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Definitions:

Q7: Reporting the financial condition of a business

Q13: Martha is a regional supervisor who earns

Q21: The ethical principle of due care pertains

Q30: Trick's Costumes has 65 employees,who are distributed

Q40: In vertical analysis,each item is expressed as

Q46: Accrual accounting requires the use of many

Q53: Andreosatos Enterprises has received a letter from

Q67: For EFG Co. ,the transaction "Receipt of

Q91: As of December 31,Year 1,Gant Corporation had

Q129: Merchandise subject to terms 1/10,n/30,FOB shipping point,is