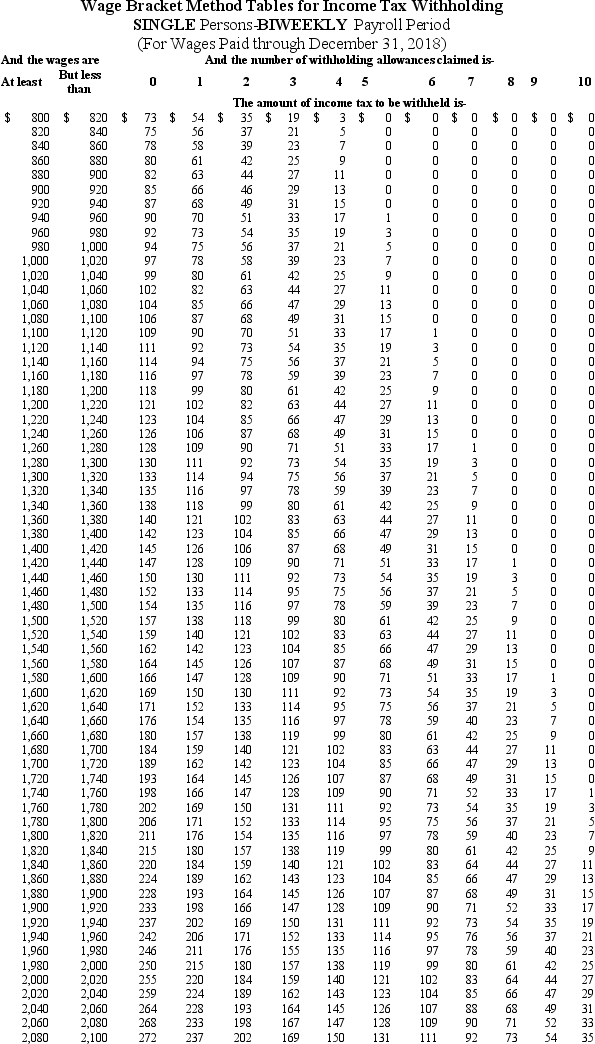

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period.She is single with 1 withholding allowance and both lives and works in Maryland.Assuming that she had no overtime,what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables.Maryland state income rate is 2.0%.Round final answer to 2 decimal places. )

Definitions:

Double-Declining-Balance Method

An accelerated method of depreciation that doubles the normal depreciation rate.

Journal Entry

A record of a transaction in the accounting journal that may affect one or more accounts.

Residual Value

The projected worth of an asset at the time of sale, after it has served its purpose.

Accumulated Depreciation

The cumulative depreciation of an asset up to a single point in its life, representing the wear and tear, deterioration, or obsolescence of the asset.

Q12: On January 1,Year 1,Mayer Corporation signed

Q14: On October 15,Eco Brewers had a balance

Q25: A(n)_ is a collection of cash and

Q25: Publication _ is the employer's guide to

Q38: Under the special accounting rule,benefits provided in

Q46: The _ is the master document that

Q48: According to FMLA,during the time that an

Q48: Which of the following is used in

Q51: Trick's Costumes has 65 employees,who are distributed

Q70: Valdez Co.sold land that had cost $48,000