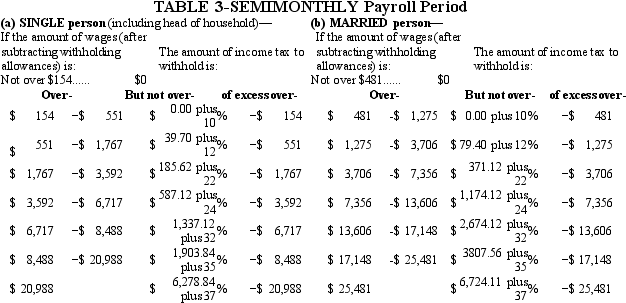

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

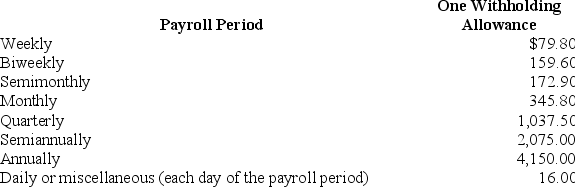

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Definitions:

Mixed Strategy Equilibrium

A solution concept in game theory where players choose a probability distribution over possible actions, ensuring no player can benefit from changing their strategy unilaterally.

Company Policy

A set of principles, rules, or guidelines formulated or adopted by a company to achieve its long-term goals and manage its internal affairs.

Money Value

The purchasing power of money, which can be affected by inflation and the general price level of goods and services.

Arthur

In the context of economics, Arthur does not directly relate to a specific key term; in other contexts, it could refer to a person's name or a historical figure.

Q16: Which of the following transactions is a

Q23: Deferred revenues (unearned revenues)are items initially recorded

Q36: Hodges,Inc.had the following assets and liabilities as

Q51: The following partial balance sheet is provided

Q56: Refer to Exhibit 2-1.What is net income,assuming

Q56: An adjusting entry would adjust an expense

Q74: Which method of reporting cash flows from

Q76: Which of the following statements regarding the

Q86: Anthony,Inc.buys land for $50,000 cash.The net affect

Q92: XYZ Co.paid $1,000 in dividends to stockholders.How