Collin is a full-time exempt employee in Juneau,Alaska,who earns $135,000 annually and has not yet reached the Social Security wage base.He is single with 1 withholding allowance and is paid semimonthly.He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25,respectively.Collin has a child support garnishment of $300 per pay period.What is his net pay? (Use the percentage method.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

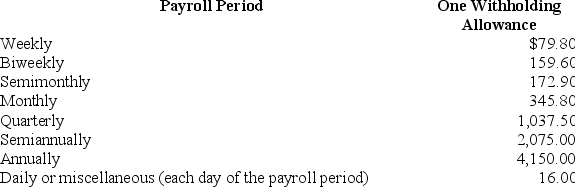

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

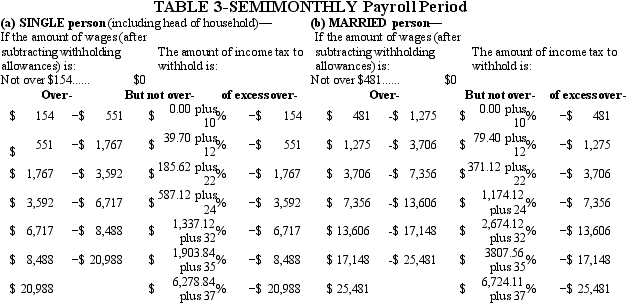

Federal Income tax using percentage method

Definitions:

Investors

Individuals or entities that allocate capital to different types of investments with the expectation of generating a future return.

Residual Claim

A claim on a company's assets and income that is only payable after all other debts and liabilities have been settled.

Treasury

Refers to the government department responsible for managing the revenue, spending, and overall financial policies of a country. It can also refer to the corporate division dealing with financial and liquidity management in a company.

Voting Rights

The rights of shareholders to vote on corporate matters, such as electing the board of directors or approving corporate policies.

Q1: A worker who sells life insurance on

Q7: Reporting the financial condition of a business

Q8: The _ reflects all unpaid payroll liabilities

Q9: Cralic Company has 12 employees and operates

Q33: Julio is single with 1 withholding allowance.He

Q40: Which of the following is an appropriate

Q48: Allen is an employee of the foreign

Q59: For EFG Co. ,the transaction "Cash sales

Q65: Which of the following is an includible

Q85: The financial statements are affected by which