Multiple Choice

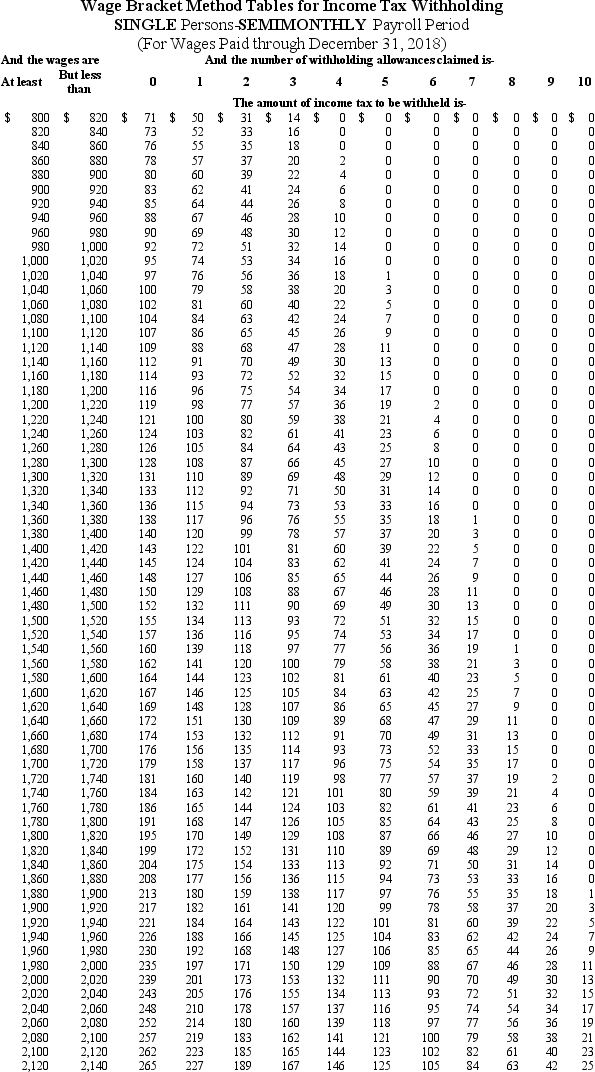

Max earned $1,019.55 during the most recent semimonthly pay period.He is single with 1 withholding allowance and has no pre-tax deductions.Using the following table,how much should be withheld for federal income tax?

Definitions:

Related Questions

Q8: If a fringe benefit involves a deduction

Q18: Which of the following should be shown

Q20: Which of the following accounts is a

Q23: Cole is a minimum wage employee in

Q35: What is the difference in pay practices

Q36: The accrual basis of accounting recognizes<br>A)revenues when

Q37: Which of the following represents a payroll

Q42: Expenses can be defined as<br>A)assets consumed.<br>B)services used

Q56: Rushing River Boats has the following data

Q61: Cyrus is a tipped employee in Illinois.He