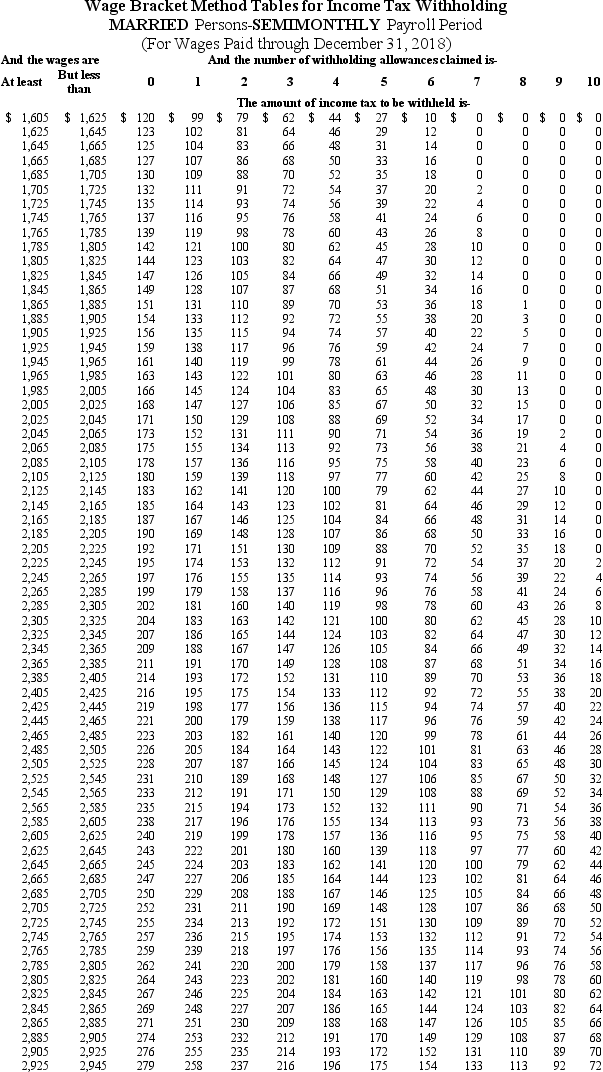

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances and has no pre-tax deductions.Based on the following table,how much should be withheld from her gross pay for Federal income tax?

Definitions:

Direct Materials

Raw materials that are traceable to the product and included in the direct costs of manufacturing.

Fixed Manufacturing Overhead

Represents the consistent costs associated with manufacturing that do not fluctuate with the level of production, such as rent, salaries, and equipment depreciation.

Direct Labor Cost

The wages and other compensation paid to employees who are directly involved in the production of goods or services.

Variable Costing

An accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in product costs, excluding fixed overhead.

Q24: Under accrual accounting,expenses are recorded when incurred

Q27: Which of the following reports links the

Q30: Payroll accruals reflect the amount of payroll

Q36: The accrual basis of accounting recognizes<br>A)revenues when

Q53: Shares of ownership are evidenced by issuing<br>A)bonds

Q55: Which are steps in the net pay

Q61: More that 70% of businesses are organized

Q64: A to Z Corporation engaged in the

Q68: When a business borrows money,it incurs a(n)<br>A)tax.<br>B)liability.<br>C)receivable.<br>D)addtional

Q80: Orange Co.sells merchandise on credit to Zea