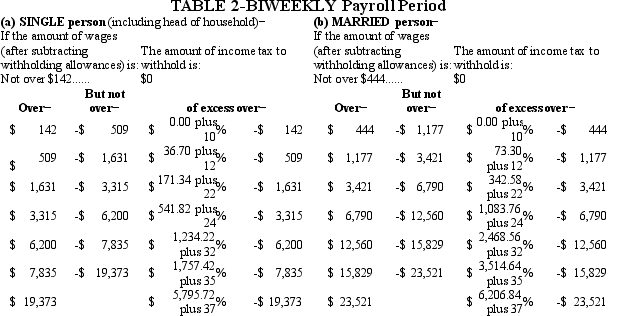

Warren is a married employee with six withholding allowances.During the most recent biweekly pay period,he earned $9,450.00.Using the percentage method,compute Warren's federal income tax.(Do not round intermediate calculations.Round your final answer to 2 decimal places. )

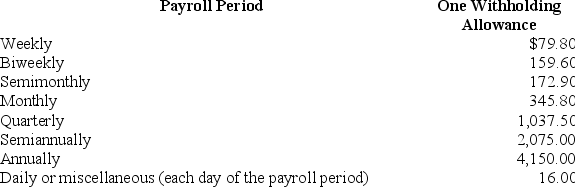

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Definitions:

Participation

The act of taking part or being involved in an activity, process, or discussion, contributing to decision-making or achieving a common goal.

Employees

Individuals who are hired by an organization to do specific work in exchange for compensation.

Time Consuming

Describes tasks or activities that require a large amount of time to complete.

Situational Model

A framework that analyzes behavior based on the situation and the individual's personality and emotions.

Q6: Which Act governs the minimum wage that

Q16: Under the Affordable Care Act,what are the

Q29: Upon termination,which of the following must be

Q31: On April 1,Bear,Inc.paid $2,400 for an insurance

Q36: Piece-rate pay is used for employees who

Q37: The _ mandated that new hires must

Q48: Annabelle is employed as an administrator for

Q52: Which ratios measure a company's long-term debt

Q56: An accountant must remain current in his

Q63: FATCA enforcement has been difficult because the