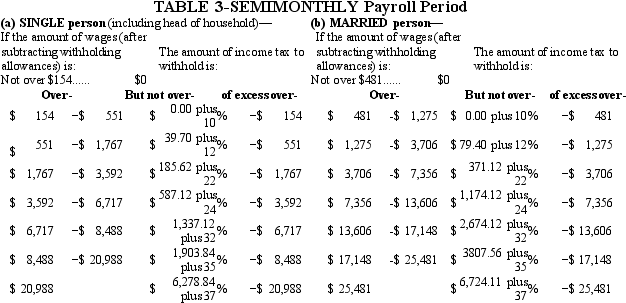

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

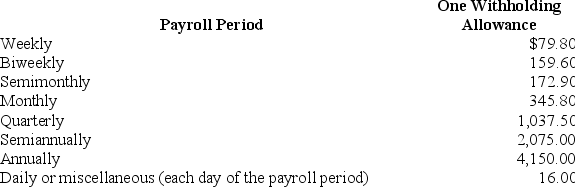

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

Definitions:

Q26: Using accrual accounting,expenses are recorded and reported

Q35: According to the Affordable Health Care Act,employers

Q36: Which of the following must accompany a

Q38: McHale Enterprises has the following incomplete General

Q38: Which of the following statements is true?<br>A)Investors

Q54: Under a premium-price emphasis,a business designs products

Q58: What effect does depreciation expense have

Q63: The payroll register is a confidential company

Q74: The accounting profession assumes that financial statement

Q75: Governments have an interest in the economic