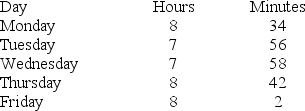

Quinn works the following hours during a one-week period:

Under the hundredth-hour method,how many hours has he worked?

Definitions:

Overhead Rate

The rate used to allocate manufacturing overhead to individual units of product, typically based on a standard measure such as labor hours or machine hours.

Normal Costing System

An accounting method that assigns indirect costs based on a predetermined rate and direct costs based on actual values.

Actual Overhead Costs

The real expenses incurred for indirect materials, labor, and other costs that are not directly tied to the production of goods or services.

Predetermined Overhead Rate

The predetermined overhead rate is calculated by dividing estimated total overhead costs by an estimated allocation base, used to allocate overhead to products or job orders.

Q10: Vincent is a tipped employee who earns

Q35: Which of the items below is NOT

Q37: Payroll taxes for which the employer is

Q44: The purpose of paycards as a pay

Q64: Indra is an employee who is required

Q66: An example of an accounting software package

Q73: Oglethorpe Corporation reported a beginning balance of

Q81: On May 31,2010,Deana's Services Company had account

Q84: What effect does the following journal entry

Q85: Stockholders' Equity will be increased by all